A reader asks:

I used to be within the camp that the Fed wasn’t going to chop charges in any respect in 2024. Alas, it seems like I will likely be unsuitable and a September or November charge lower is all however assured at this level. So what are the portfolio implications if we enter a charge slicing cycle? When do I get out of my T-bills?

The Fed in all probability ought to have lower charges at their assembly this week however I suppose a few months shouldn’t matter within the grand scheme of issues.

My rivalry is the Fed issues far lower than most individuals assume relating to the markets. Certain, they’ve the power to have an effect on the markets within the short-term and through occasions of disaster, however Jerome Powell just isn’t the wizard backstage pulling all of the strings.

The Fed doesn’t management the inventory market. And so they solely management the quick finish of the bond market.

Nonetheless, modifications to rates of interest do impression your portfolio. It may be useful to know what can occur to the monetary markets when the Fed raises or lowers short-term charges.

The rationale for the Fed charge lower in all probability issues greater than the speed lower itself.

If the Fed is slicing charges in an emergency trend, like they did through the Nice Monetary Disaster, that’s a unique story than the Fed slicing as a result of the economic system and inflation are cooling off.

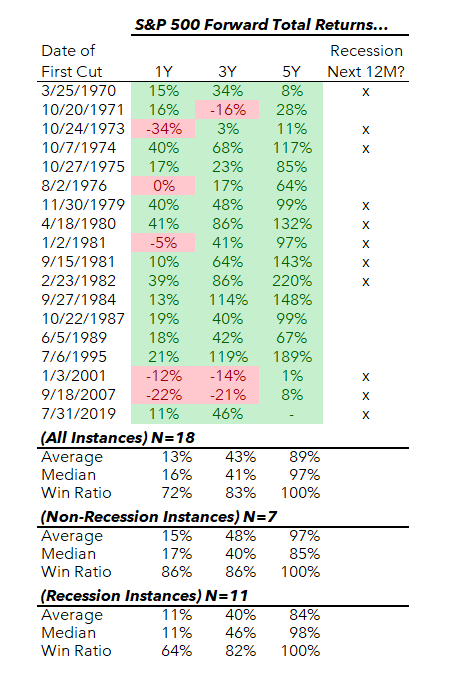

Right here’s a take a look at the ahead 1, 3, and 5 12 months returns for the S&P 500 following the Fed’s first charge lower going again to 1970:

More often than not shares had been up. The one occasions the S&P 500 was down considerably a 12 months later occurred through the 1973-74 bear market, the bursting of the dot-com bubble and the 2008 monetary disaster.

It’s been uncommon for shares to be down three years later and the market has by no means been down 5 years after the preliminary charge lower.

Typically the Fed cuts as a result of we’re in or quick approaching a recession, however that’s not at all times the case.

Right here’s a take a look at the variations in ahead returns throughout recession and non-recessionary charge lower conditions:

Common returns have been higher when no recession happens however the disparity isn’t as giant as you’ll assume.

More often than not the inventory market goes up however generally it goes down applies to Fed charge cuts similar to it does to each different time limit.

Clearly, each charge lower cycle is completely different. This time it’s going to occur with shares at or close to all-time highs, large positive factors from the underside of a bear market, a presidential election, and the sequel to Gladiator popping out this fall.

I’m undecided charge cuts sign a lot of something to the inventory market proper now, contemplating it’s forward-looking and already is aware of the inflation information cooled and the Fed will lower in some unspecified time in the future.

The inventory market cares about earnings so the economic system cooling off or remaining sturdy seemingly issues greater than a few charge cuts by the Fed.

The place the speed cuts actually matter are for the yields in your money and cash-like securities.

You possibly can see the three month T-bill yield is actually the identical factor because the Fed Funds Fee:

When the Fed cuts charges you will note yields drop on T-bills, financial savings accounts, cash market funds, CDs, and many others.

Holding money equivalents through the charge mountain climbing cycle was an clever transfer. There was no rate of interest danger. The yields on these merchandise and accounts regulate shortly when charges rise (or fall). Plus, the yields on T-bills and the like had been greater than longer period mounted revenue as a result of the yield curve was inverted.

Longer-dated bonds had decrease yields and skilled huge drawdowns from rising charges. Money had greater yields, no nominal drawdowns, and no volatility.

It was one of the best of each worlds.

Issues turn out to be slightly trickier now.

There may be reinvestment danger in money equivalents. When the Fed cuts charges, these yields will fall and fall shortly. Clearly, it relies upon how far the Fed cuts charges throughout this cycle.

Many traders can be completely content material to carry onto T-bills if charges go from north of 5% to 4% or so. However when do you begin getting nervous? Do you continue to need these T-bills at 3%?

As with most allocation selections, there are not any proper or unsuitable solutions right here. These decisions boil all the way down to why you maintain T-bills within the first place.

Have been you on the lookout for liquidity, an absence of volatility and a secure house to keep away from nominal drawdowns?

T-bills present that it doesn’t matter what the Fed does. You simply won’t be paid as a lot going ahead.

Have been you hiding out from rate of interest danger in bonds with the next yield as well?

Do you wish to transfer out additional on the danger curve to lock in greater yields or profit from a possible decline in charges?

The bond market doesn’t wait round for the Fed.

The ten 12 months Treasury yield spiked to five% in October of final 12 months.1 Right here’s how the yield curve has modified since then:

The bond market knew charge cuts had been coming and moved in anticipation of them. At present’s yields are nonetheless significantly better than they had been earlier than the rate-hiking cycle started, however it’s tough to understand how a lot of the Fed’s strikes have already been priced in.

Bonds do have a a lot greater margin of error with charges at present ranges, nonetheless present a pleasant hedge in opposition to deflation or disinflation and may function a flight to security throughout a recession.

So, there’s not a lot we are able to say with certainty a couple of charge lower. All of it depends upon the variety of charge cuts, financial efficiency, the variety of new Taylor Swift live performance dates, and many others.

The excellent news is you don’t must go to the extremes, put your whole mounted revenue eggs in a single basket and nail the timing of the rate of interest cycle.

There could be a place for money equivalents in your portfolio so long as you perceive the professionals and cons of this asset class.

There could be a place for bonds in your portfolio so long as you perceive the professionals and cons of this asset class.

The truth that we’re ranging from a lot greater yield ranges than we’ve seen within the earlier 15 years or so provides you the next margin of security in no matter route you select.

My solely recommendation can be to keep away from making an attempt to leap out and in of those asset courses primarily based by yourself rate of interest forecasts.

Nobody can predict the route of rates of interest or the magnitude of the strikes earlier than they occur.

I desire to have a look at these allocation selections by way of the lens of the trade-offs between danger and reward.

Each funding resolution requires trade-offs.

We spoke about this query on this week’s all new Ask the Compound:

Our resident insurance coverage skilled and monetary advisor, Jonathan Novy, joined me on the present this week to debate questions on life insurance coverage vs. investing, HELOCs, taking out a mortgage to rework your own home and the way the step-up foundation works when one partner passes away.

Additional Studying:

The Fed Issues Much less Than You Assume

1There have been a variety of theories concerning the reasoning for this on the time. See right here.